The Only Guide for Simply Solar Illinois

Wiki Article

The Facts About Simply Solar Illinois Revealed

Table of ContentsWhat Does Simply Solar Illinois Mean?Some Known Questions About Simply Solar Illinois.About Simply Solar IllinoisThe Only Guide to Simply Solar IllinoisOur Simply Solar Illinois Diaries

Our team companions with local areas across the Northeast and beyond to deliver clean, budget-friendly and trustworthy power to cultivate healthy and balanced neighborhoods and maintain the lights on. A solar or storage space job provides a number of benefits to the neighborhood it serves. As technology developments and the price of solar and storage space decline, the economic benefits of going solar remain to rise.Assistance for pollinator-friendly environment Environment repair on polluted websites like brownfields and garbage dumps Much required shade for animals like lamb and chicken "Land banking" for future agricultural use and soil top quality renovations As a result of environment change, severe weather condition is ending up being extra regular and disruptive. As a result, house owners, services, communities, and energies are all coming to be a growing number of interested in securing power supply options that provide resiliency and power security.

Environmental sustainability is another essential motorist for businesses purchasing solar energy. Lots of business have robust sustainability goals that consist of reducing greenhouse gas exhausts and utilizing less resources to help minimize their effect on the native environment. There is an expanding urgency to resolve climate adjustment and the stress from customers, is getting to the leading degrees of organizations.

Simply Solar Illinois - The Facts

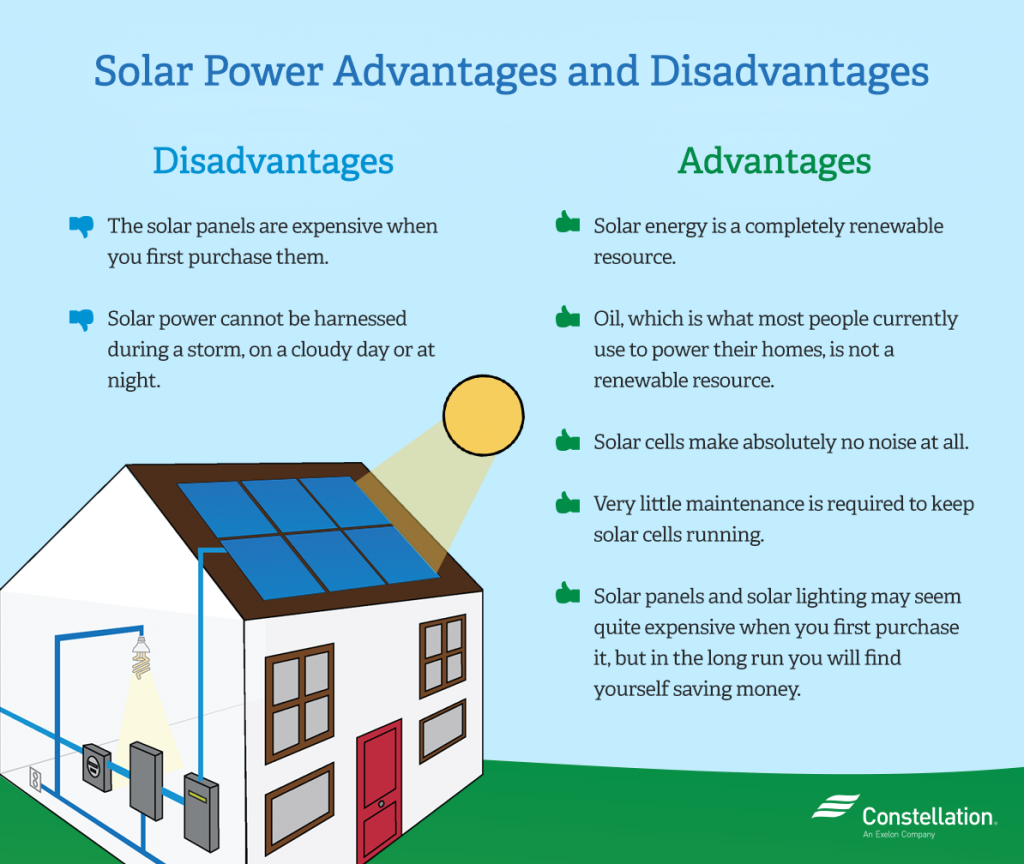

As we come close to 2025, the combination of solar panels in industrial jobs is no more just a choice but a tactical requirement. This blogpost dives right into exactly how solar power works and the multifaceted advantages it gives business structures. Solar panels have actually been made use of on domestic buildings for years, however it's only recently that they're becoming a lot more usual in industrial building.

In this write-up we go over exactly how solar panels job and the advantages of utilizing solar energy in commercial buildings. Electrical power prices in the United state are increasing, making it extra expensive for businesses to operate and much more tough to plan ahead.

The United State Energy Info Management anticipates electric generation from solar to be the leading resource of development in the united state power industry through completion of 2025, with 79 GW of brand-new solar capability predicted to come online over the following two years. In the EIA's Short-Term Energy Overview, the agency claimed it anticipates renewable resource's general share of electrical energy generation to increase additional resources to 26% by the end of 2025

Some Known Factual Statements About Simply Solar Illinois

The sunlight triggers the silicon cell electrons to propel, producing an electric present. The photovoltaic solar cell takes in solar radiation. When the silicon connects with the sunlight rays, the electrons begin to move and produce a flow of direct electric existing (DC). The cables feed this DC electricity into the solar inverter and convert it More Info to alternating power (AIR CONDITIONER).There are a number of ways to store solar power: When solar energy is fed right into an electrochemical battery, the chain reaction on the battery elements keeps the solar power. In a reverse response, the existing leaves from the battery storage space for usage. Thermal storage space utilizes mediums such as liquified salt or water to retain and absorb the warm from the sunlight.

This system stores pressed air in huge vessels such as containers or all-natural developments (e.g., caverns), after that releases the air to produce electricity. Electricity is just one of the biggest ongoing expenditures that commercial buildings have. Photovoltaic panel considerably lower energy expenses. While the initial financial investment can be high, overtime the price of mounting photovoltaic panels is recovered by the money saved money on electrical energy bills.

Facts About Simply Solar Illinois Revealed

By setting up photovoltaic panels, a brand name reveals that it cares regarding the environment and is making an initiative to lower its carbon impact. Structures that depend entirely on electrical grids are at risk to power interruptions that occur throughout negative weather or electric system breakdowns. Photovoltaic panel mounted with battery systems permit commercial structures to continue to operate throughout power interruptions.

Examine This Report on Simply Solar Illinois

Solar power is one of the cleanest types of energy. In 2024, house owners can benefit from federal solar tax rewards, permitting them to balance out virtually one-third of the purchase cost of a solar system through a 30% tax credit rating.Report this wiki page